THE POLICY

JumpStart Seattle is a progressive payroll tax to JumpStart Seattle’s economy. It’s progressive in that it taxes both the largest and wealthiest companies, and the largest six figure salaries within those companies. This was intentional in a post-Covid context, where certain companies actually profited from the pandemic while other small business and service sector employers struggled to survive. The JumpStart tax generated much needed progressive revenue in the state’s most prosperous city, which also has the most regressive tax structure. The three-part investment plan first provides immediate Covid relief to families in Seattle through food vouchers; direct cash assistance to immigrants and refugees left behind in the federal unemployment system; rental assistance vouchers to keep families housed; and support for small businesses and childcare providers. The city also avoided austerity budgeting through JumpStart, bringing in progressive revenue to protect critical public services and public sector workers during the recession. Finally, the plan provides for long-term economic recovery through investments in housing and a post-Covid-19 economy.

Beginning in 2022, the Jump Start plan directs 62 percent of the funds allocated for housing (about $135 million in 2022, and growing annually thereafter). Of that, 82 percent is for building affordable rental housing (prioritizing 0-30 percent AMI but can support projects serving up to 60 percent AMI); 13 percent is for housing and services for community-focused acquisition development, and program support fund to affirmatively further fair housing and to address past discriminatory policies and practices; and five percent of the funds for housing and services may be used for permanently affordable homeownership opportunities.

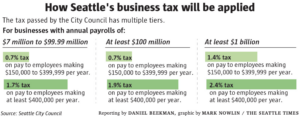

The investments are funded by a modest, yet progressive, payroll tax on Seattle’s largest businesses over the next 20 years. The vast majority of Seattle businesses will not be subject to the tax because the ordinance excludes businesses with less than $7 million of annual Seattle payroll and does not place an assessment on salaries under $150,000. The progressive revenue tax has three tiers. (1) Businesses with payroll between $7 million and $100 million are taxed at rates between 0.7 to 1.9 percent on salaries paid to Seattle employees making $150,000 to $399,999 per year. (2) A higher set of tax rates are applied to Seattle employees making $400,000 per year. (3) Businesses paying at least $1 billion in payroll are taxed between 1.4 to 2.4 percent.

The JumpStart plan was built over three months with a coalition of 100+ nonprofits , labor unions, small and large businesses, and community advocates. This coalition came to the table representing business; labor; immigrant and refugee rights organizations; transportation and environmental advocates; neighborhood groups; equity-based organizations; food security advocates; and housing and homelessness advocates. The campaign involved thousands of hours of engagement with stakeholders, strong policy development, strategic communications, and commitment. Businesses that would pay the tax were also at the table.

Notably, this plan passed after a very public rollback of an Employee Hours Tax (a head tax) in 2018, with many believing it was impossible to levy a progressive businesses tax. The Employee Hours Tax failed because it was a tax on all Seattle businesses, including some small businesses like grocery stores. This made it easier for the business community to organize to defeat the tax with the threat of putting it on the ballot. What made this progressive tax so different is its narrowly-defined target of big businesses with high-earning employees. This is especially resonant at a time when Seattle’s wealth gap is widening, as it was even before Covid hit. This narrow focus led prominent local columnist Danny Westnead to dub Jumpstart the “boss tax,” saying it avoided the head tax’s fatal flaw, and even earmarked millions of dollars in Covid relief funding for the very small businesses the head tax had included.

COLLABORATIVE GOVERNANCE

Community advocates called on Councilmember At-Large Teresa Mosqueda’s office to work on a progressive revenue source to fund much-needed supports and services in the community. Community advocates worked to identify spending priorities and design policy levers for the taxation source. Part of the tremendous success of JumpStart Seattle was due to the unique alliance of community organizations and traditional opponents, including big businesses like Expedia, who came to the table to secure the largest progressive business tax the city has seen in decades.

EQUITY

Regressive forms of taxation, such as sales tax, place a disproportionate burden on working families and communities of color. By design, JumpStart targets Seattle’s larger businesses to institute truly equitable taxation. JumpStart Seattle leverages taxes from Seattle’s larger businesses to provide economic recovery and stability for those who have lost jobs, those facing eviction, etc.

On the spending side, Jumpstart Seattle invests in areas proven to build wealth for BIPOC communities. This includes, for example, funding for Black homeownership and long term spending for small businesses. By investing in the areas that make communities healthy (housing, small business, Green New Deal policies, and the Equitable Development Initiative) the city is centering those who are most harmed by years of racist policymaking. Specifically, investing in the Equitable Development Initiative is a way that this policy will actively fight displacement, which disproportionately impacts Black communities. The Equitable Development Initiative funds community-led development projects and programs. Examples of past funded projects include the renovation and expansion of community space for Seattle’s Black elders, funding for an East African community-based K–8 school to purchase their property, and a mixed-use affordable housing project that mainly serves homeless Native/American Indian/Alaskan Native Seattle residents.

The decisions on spending were made by a large group of community advocates. There was consensus that while long-term the progressive tax should fund affordable housing, equitable development and small business supports, short-term we needed to prioritize direct assistance to Seattle families suffering from the immediate impacts of the Covid economic crisis.

ANALYSIS

- Washington State has no income tax. Seattle tried to pass its own income tax on wealthy households, but that was defeated in court. Additionally, there was a state legislature effort to pass a progressive business tax in 2018, but that also failed to gain enough momentum for a vote.

- Local government dynamics: The Seattle City Council is a progressive body that finds itself in opposition to the mayor on certain issues. As a result of Covid-19 and the dire need for funding to maintain services, the council was firmly in support of the measure.

- Policy: The modest 20-year business tax is a strong example of progrsesive local municipal taxation and puts the city on significantly more solid financial footing during the pandemic, while prioritizing services and supports for the most vulnerable.

This case study was last updated: January 19, 2021.